AXIS CREDIT CARD ACTIVATION PROCESS - AXIS CREDIT CARD BENIFITS

Friends welcome to another new article, This article is about the Axis Credit Card application process. We will know in detail about Axis Credit Card. For example; Benefits, who can apply, age requirement, self employed and salaried person can apply? I will try to present all these information today through this article.

You can see the procedure of applying for Axis Credit Card in video format; Click here

So come on guys, let's start the article.

First we will know about the benefits of axis card, then who is eligible and who can apply, and lastly we will discuss how to apply axis credit card.

✓ BENIFITS

The first advantage of Axis Credit Card is that the customer does not have to pay any interest rate for up to 45 days.

The second advantage is that axis credit card gets approved faster than other credit cards.

The third advantage is that axis credit card is fully digital and paperless. You can approve axis credit card online at home through video kyc.

Benefit number four is that axis credit card has many discounts, rewards and offers all the time.

★ WHO CAN APPLY?

Minimum age to apply is 18 years. And must be a working professional.

Valid PAN card and Aadhaar card is required to apply. And it is also important to link mobile number with Aadhaar card.

Annual income should be 2.5 lakhs, regular income should be between 15 to 20 thousand per month.

Good credit score is required for axis credit card.

♥ HOW TO APPLY?

1… You have to click here to apply Axis Credit Card. After clicking on the link, a website will open in front of you. There you have to enter your name, mobile number, email id, pin code and click on continue.

2… After that, another page will open in front of you, there will be two options, yes or no, you have to select one of them. You select 'yes' if you are an old customer of Axis Bank, otherwise you select 'no'.

3… Then on the next page you will fill your details, The details to be filled are; Mobile number, PAN card number, pin code, net annual income etc. must be entered. When everything is filled, click on Next

4… On this page you have to enter your Aadhaar card details, such as: name as per aadhar, date of birth (as per aadhar), name desired on card and many other aadhaar related information.

Fill everything on this page well, so that you don't get any information of Aadhaar card wrong.

If you make a mistake, you may not be able to change it later.

After filling everything, you will see a box at the bottom, put a tick in that box. And you will move to the next page.

5… On this page you have to select Nature of Employment. If you are salaried you will select Salaried, and if you are self-employed you will select Self Employed here . Then click next and go to the next page.

6… In this page you have to fill up the job related information. Like: Employ Sector, Source of Fund, Type of Industry, Current Organization Name etc. many more things have to be filled. After filling all the boxes you need to click next to proceed to the next page.

7… On this page you have to select your preferred card. And you will see the details and features of the card you select under the card,

like the joining fee, annual fee etc. you will see under cards.

Once your preferred card is selected, click on Next to reach the next page

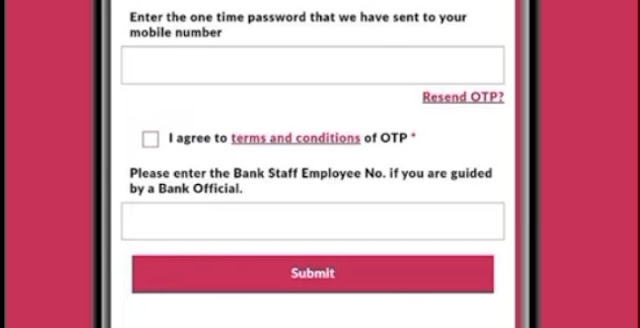

8… What do you have to do on this page, That is, an OTP will be sent to your mobile number and you have to enter that OTP here. After filling the OTP you will see a box below (I Agree) click on that box, and then Trams and Conditions will open in front of you where you have to scroll down and click on I Agree. Then you will move to the next page for the next step.

9… Finally your form fill and submission is complete. On this page you will generate a reference number and you will see a message like ("Congratulations you have moved to the next stage of the application process.")

10… Then a message will be sent to your mobile number. The message will be like this ("You are almost there! Please complete your Axis Credit Card application with reference no."). A link will be given in the message that will come to your mobile number, you have to click on that link and complete the video KYC within 72 hours of opening the account.

11… After clicking on the link, the video KYC will start in front of you like this.Axis Bank Credit Card KYC Expert will help you do 'Video KYC'. Your axis credit card application will be completed once your video kyc is completed.

12… If your video KYC is completed then a successful pop-up will appear in front of you in green color.

13… And finally you will get the congratulation message and confirm that your credit card application has been successfully submitted and KYC verified.

So friends you can apply for axis credit card very easily by following all the above steps.

Click here to watch Axis Credit Card Applying Procedure in video format.

If you have any difficulty in understanding anything then you can tell in the comment section.

♣Thank you all for reading this article♣